michigan unemployment income tax refund

In order to view status information you will be prompted to enter. The State of Michigan has issued a decision on the treatment of unemployment compensation for the 2020 tax year.

Income Tax Deadline What Last Minute Michigan Filers Need To Know

And e-File your 2021 IRS and state Taxes a IRS priority year and refund.

. His clients are basically averaging around 430 in extra state refund money after being able to reduce their taxable income by 10200. Shutterstock Michigan unemployment officials say 12 million residents about. Up to 10200 of unemployment benefits will tax exempt in conformity with IRS treatment.

You had to qualify for the exclusion with a modified adjusted gross income MAGI of less than 150000. Federal tax rates are higher meaning. Michigan Confirms Unemployment Compensation is Taxable for Tax Year 2020.

2020 Home Heating Credit MI-1040CR-7 Alternate Credit Computation. Unemployment compensation is treated as taxable income on the federal return and the Michigan income tax return. In the latest batch of refunds announced in November however the average was 1189.

The states unemployment agency is still trying to determine how many claims paid out improperly during the pandemic will have to be recouped putting workers in a tough spot during tax season. By accessing and using this computer system you are consenting to system monitoring for law enforcement and other purposesUnauthorized use of or access to this computer system may subject you to state and federal criminal prosecution and penalties as well as civil penalties. The federal American Rescue Plan Act excludes unemployment benefits up to 10200 from income for tax year 2020 for those within.

However you dont pay tax in Michigan on unemployment if you no longer live in Michigan. State Unemployment Insurance Compensation debts are now eligible for referral to Treasury Offset Program The Department of Treasurys Bureau of the Fiscal Service BFS issues IRS tax refunds and Congress authorizes BFS to conduct the Treasury Offset Program TOP. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year.

Than 21 days refund. You can find this by signing in to TurboTax and scrolling down to Your tax returns documentsSelect 2021 then View adjusted gross income AGI in the right column. And yes that unemployment compensation is treated as taxable income on the federal return and the Michigan income tax return.

Say Thanks by clicking the thumb icon in a post. Michigans state income tax is 425. Michigan officials arent sure how many Michiganders are owed state unemployment tax refunds Leix said.

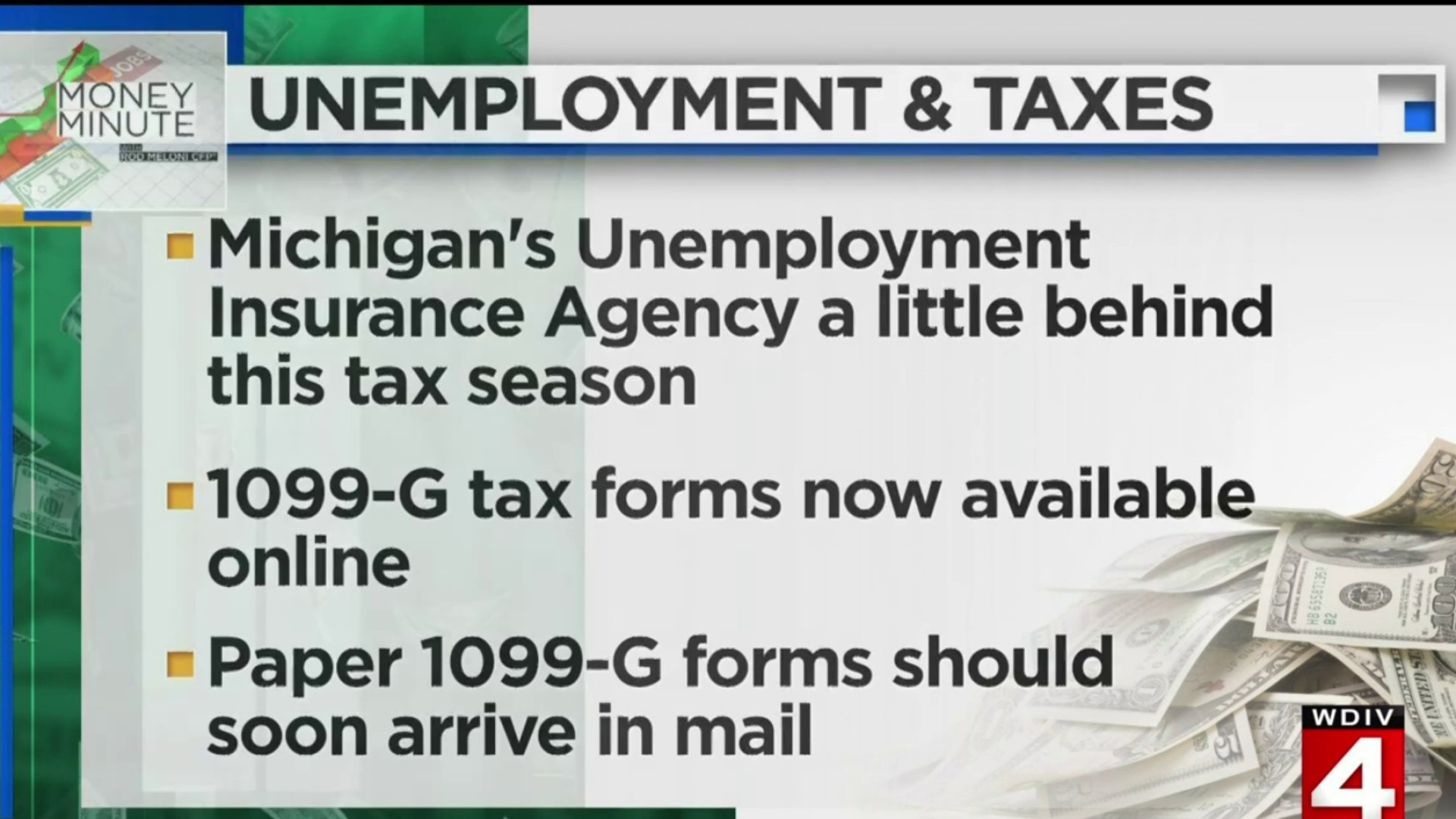

500 michigan unemployment tax refund 2021 500 750 1250 or. That means the average refund for one week of unemployment from last spring and summer would be roughly 40. Michigan unemployment 2021 tax form coming even as benefit waivers linger.

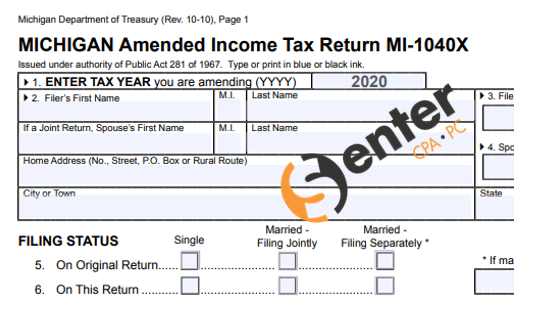

These taxpayers should file an amended Michigan income tax return to claim that refund. Mortgage Foreclosure or Home Repossession and Your Michigan Individual Income Tax Return TABLE A. 2020 Home Heating Credit MI-1040CR-7 Standard Allowance TABLE B.

MoreMichigan jobless claimants wont get key tax form until end of February. June 1 2019 236 PM No. You pay tax in your home state only.

Unemployment compensation is subject to tax in Michigan. Cities can levy income taxes as well. I DID NOT file a tax return I DID NOT authorize to have a tax return filed on my behalf.

Taxpayers eligible to receive a refund due to reporting the unemployment exclusion include taxpayers who claimed a refund on the original Michigan return and taxpayers who paid any tax due with the filing of that original return. Federal tax rates are much higher between 10. Yes they can take both state and federal refunds.

Therefore unemployment compensation is also included in Michigan taxable income. A 39 refund Processing Service fee to. Social Security number SSN Tax year Filing status Adjusted Gross Income AGI or.

Tax rates top out at 240 in Detroit hard to incorporate all states changes TurboTax. This system contains US. The state will ask you to enter your adjusted gross income AGI.

Sales and Use Tax. Unemployment compensation is generally included in adjusted gross AGI income under the IRC. Wheres my refund Michigan.

State Income Tax Range. Michigan taxpayers who collected unemployment benefits and have not yet filed a state income tax return can file their returns as soon as they are able according to the Michigan Department of Treasury. I wish to take the Michigan Identity Confirmation Quiz so my return can continue processing.

The 150000 limit included benefits plus any other sources of income. Michigan has a flat tax rate of 425. I filed a tax return I had a tax return filed on my behalf.

Theres a flat 425 tax on most income in Michigan. When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020. To check the status of your Michigan state refund online visit Michigangov.

The federal American Rescue Plan Act was signed into law on March 11 2021. State Taxes on Unemployment Benefits. Effect of the American Rescue Plan Act on the taxation of unemployment compensation.

March 24 2021. Many people of course could be stumped when it comes to whether. If Michigan tax was withheld you would have to file a Michigan return to get a refund of the Michigan withholdings.

I wish to report that return as suspicious I still need to file my Michigan return. The refund date youll see doesnt include the. You can track it at the Michigan Department of Treasury Wheres My Refund.

Michigan has a flat income tax rate of 425. The latter will vary between households depending on overall income your tax bracket and how much of your earnings came from the benefits. President Bidens recent federal American Rescue Plan Act excludes unemployment.

State Pushes Back Release Of Unemployment Aid Tax Forms

Tax Pro Income Tax Service Home Facebook

Money Minute Tax Forms Available For Michigan Unemployment Claimants

Where S My Refund Michigan H R Block

Money Monday How To Get Taxes Back On Michigan Unemployment Payments

Michigan Uia Pauses Collections On Benefit Overpayments Amid Case Reviews

Money Minute Tax Forms Available For Michigan Unemployment Claimants

This Annual Tax Reference Guide Is For Any Business That Has Employee S And Contractors Or That Hav Bookkeeping Business Business Tax Small Business Accounting

Michigan S Delayed 1099 G Unemployment Tax Forms Now Available Online Mlive Com

State Of Michigan Taxes H R Block

Michigan Just Received My State Return I Hope Everyone Gets There S Asap Filed 01 22 Accepted 02 11 Federal Ddd 02 23 Used Tt Filed Eitc And Stimulus R Irs

Michigan Department Of Treasury Treatment Of 2020 Unemployment Compensation Exclusion Senter Cpa P C

Tax Returns Tax Return Chart Powerpoint Word

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

Michigan Families Need Unemployment Benefits And A Functional System

This Quarterly Tax Reference Guide Is For Any Business That Has Employees And Contrac In 2021 Bookkeeping Business Small Business Bookkeeping Small Business Accounting

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

Americans Should Be Prepared For A Smaller Tax Refund Next Year